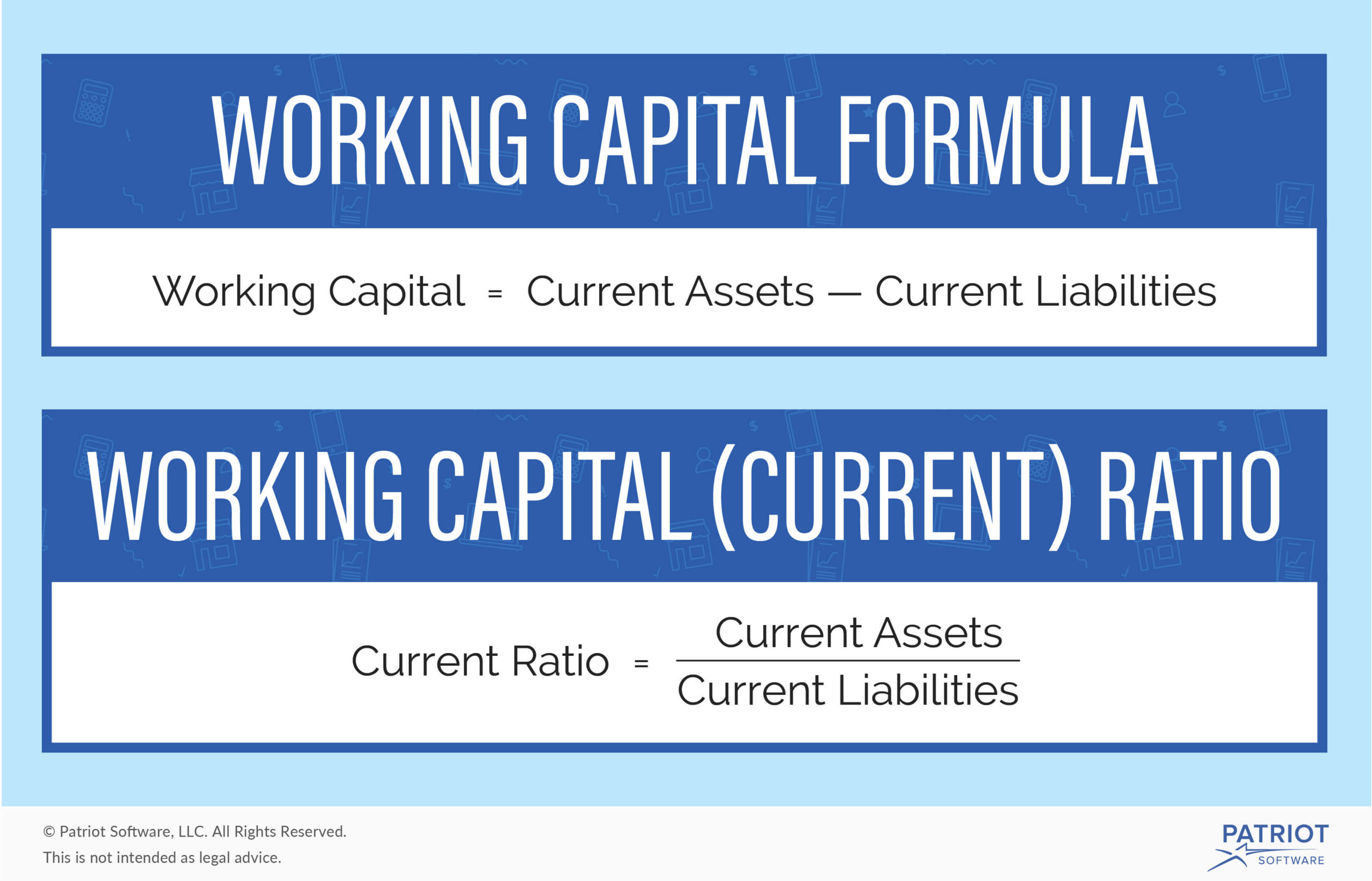

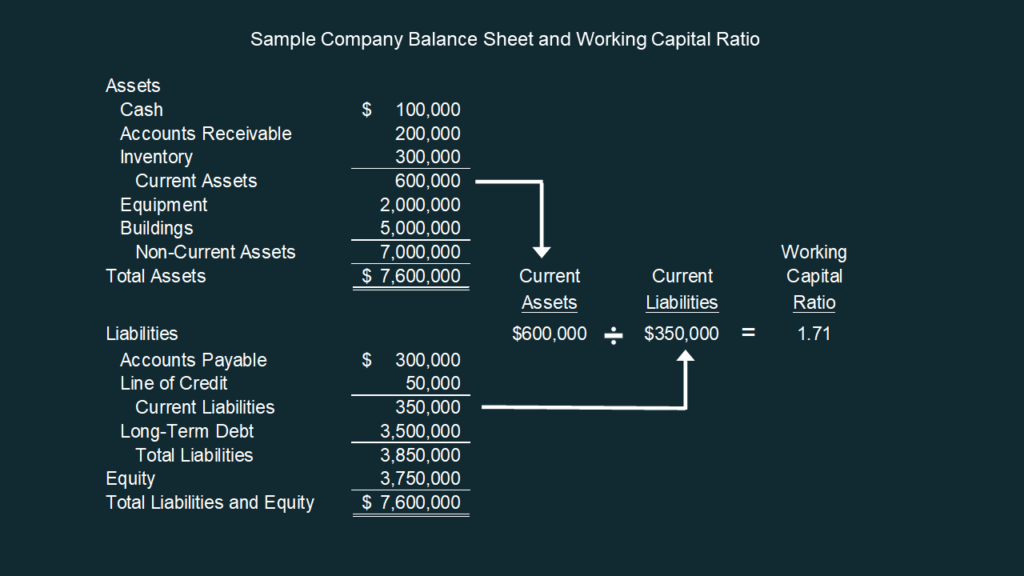

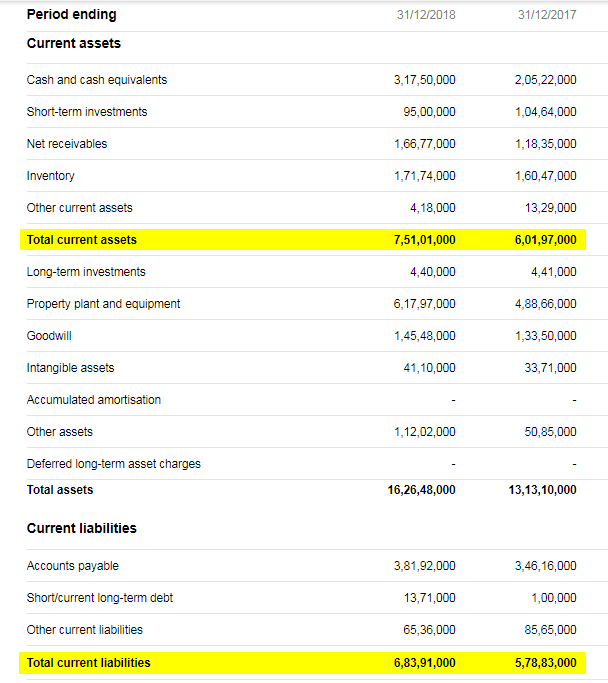

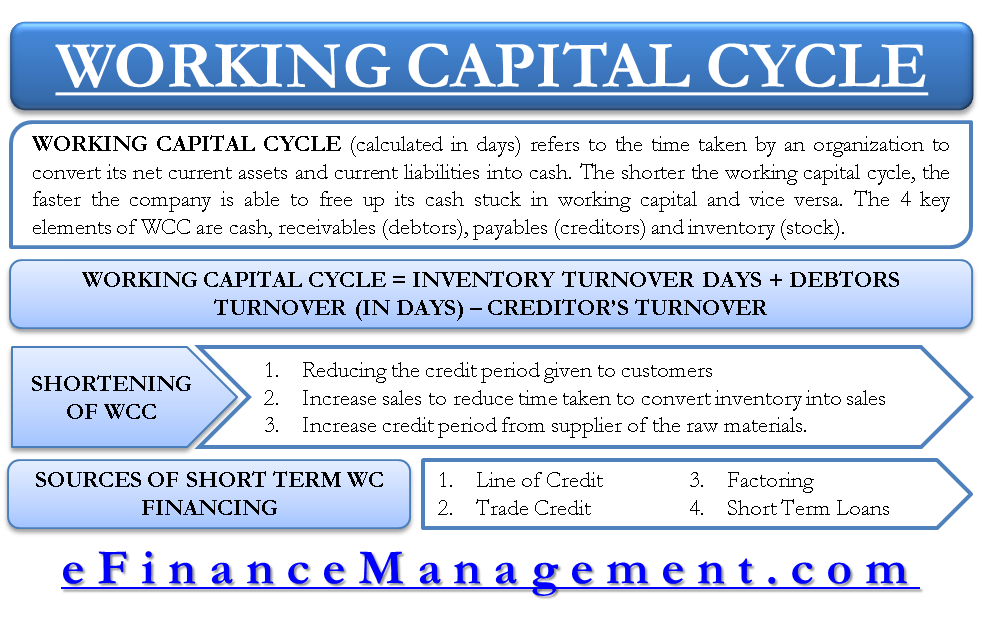

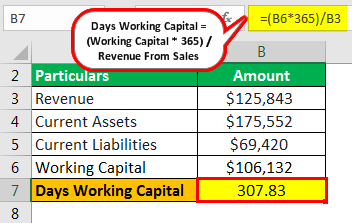

Cash Current assets divided by current liabilities is known as a working capital ratio To calculate a company's average working capital, the following formula is used (Working capital of the current year Working capital of the prior year) ÷ 2 This indicates whether a company possesses enough shortterm assets to cover shortterm debt There are two major elements to the negotiations agreeing on the working capital target amount, and agreeing on the formula for calculating the actual working capital for the target, at closing and in the trueup Here are 6 key concepts for formulating a negotiating positionInventory to working capital is a liquidity ratio that measures the amount of working capital that is tied up in inventory The difference between total current assets and total current liabilities is known as working capital or net working capitalWorking capital

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Definition

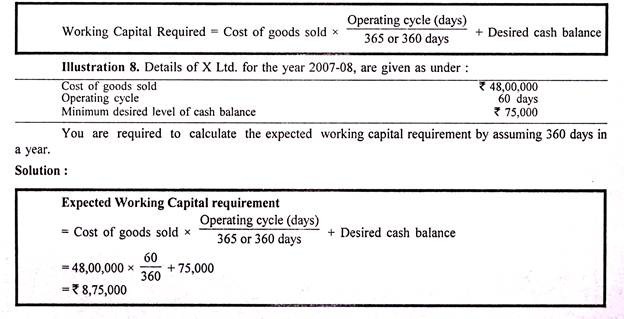

How to calculate normal level of working capital

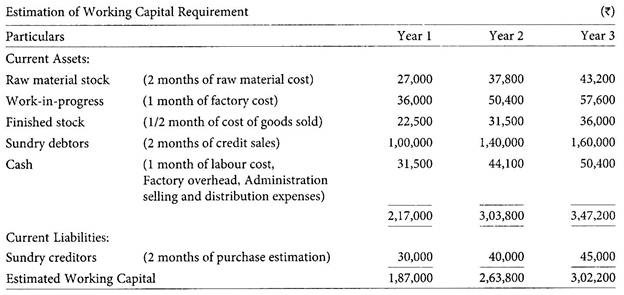

How to calculate normal level of working capital- Working With Working Capital Another piece of conventional wisdom that needs correcting is the use of the current ratio and, its close relative, the acid test or7 Working capital investment levels The working capital ratios shown above can be used to predict thefuture levels of investment (the financial position statement figure)required This is done by rearranging the formulas For example Working capital investment levels The level of working capital required is affected by the following factors

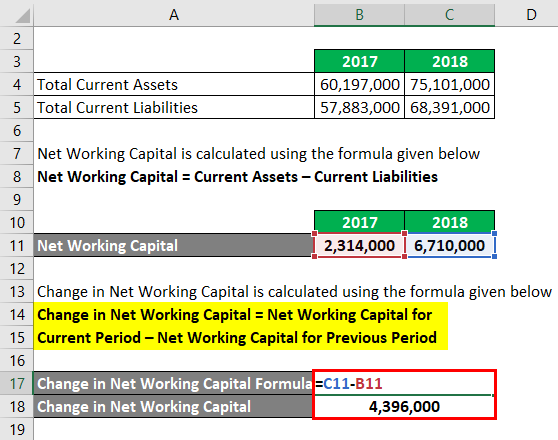

Change In Working Capital Video Tutorial W Excel Download

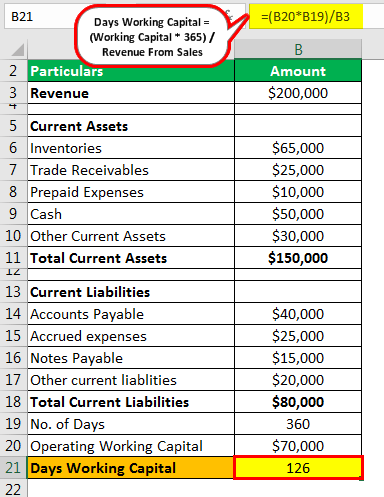

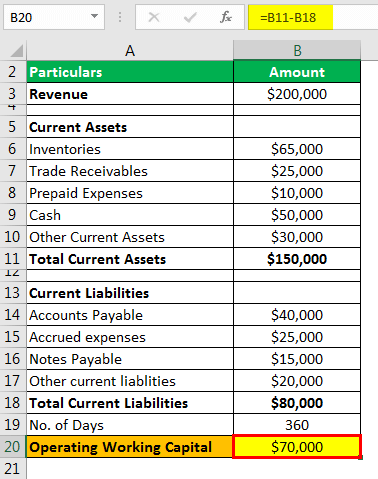

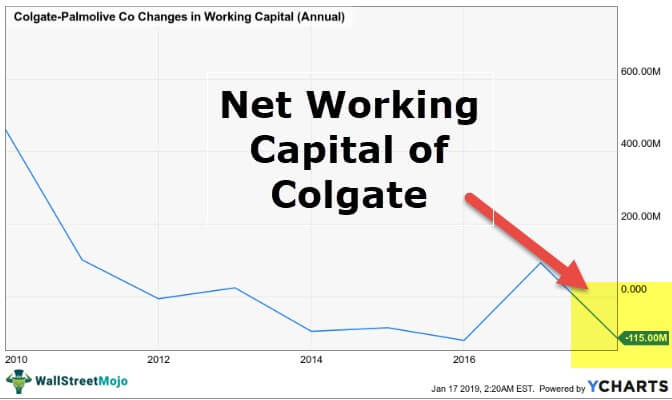

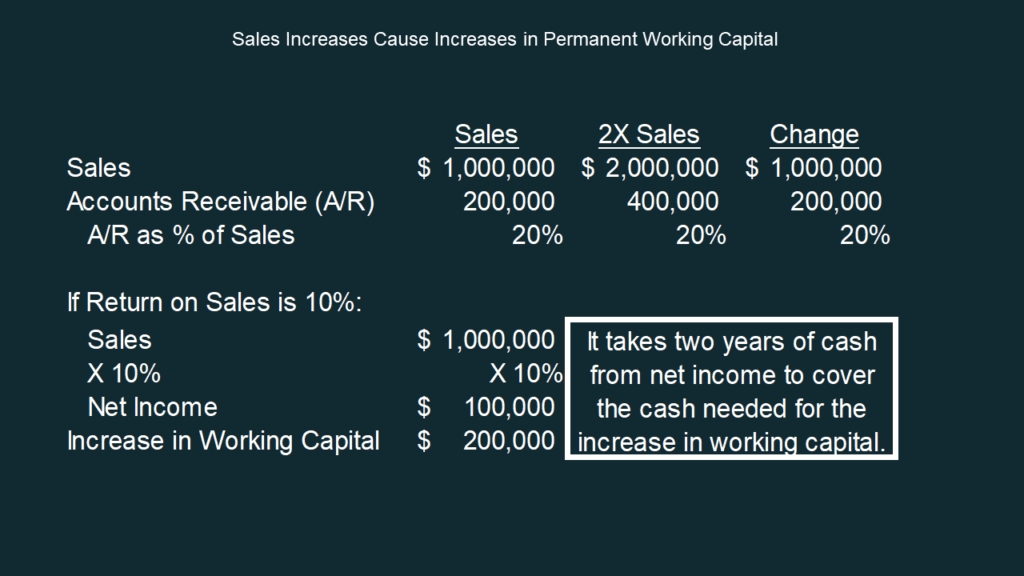

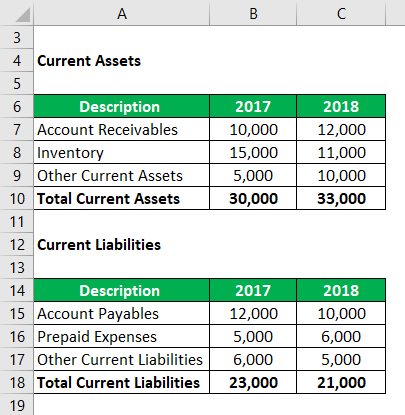

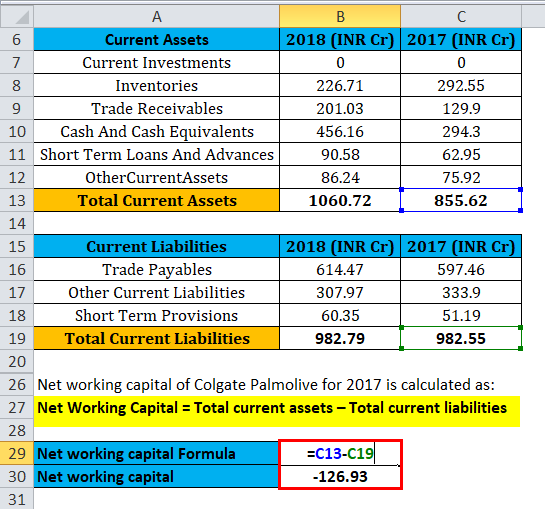

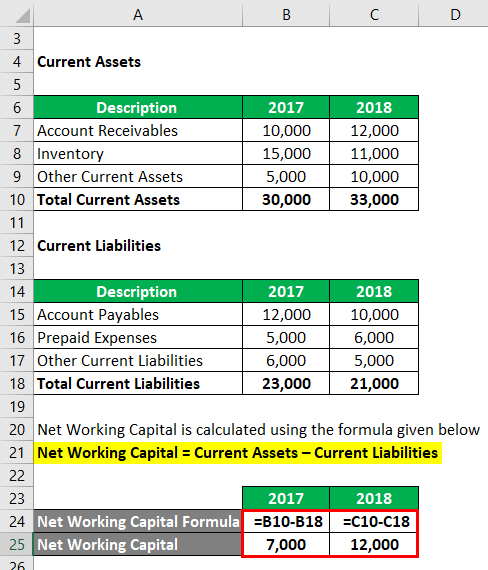

Change in Net Working Capital = 12,000 – 7,000 Change in Net Working Capital = 5,000 Since the change in net working capital has increased, it means that change in current assets is more than a change in current liabilities So current assets have increased It means that the company has spent money to purchase those assets How is net working capital determined?To determine what a "normal" level is for NWC, an average of the previous six to 12 months is often used, which may be referred to as the "target" or "peg" At closing, the actual NWC delivered is compared to an agreedupon target and a "trueup" then occurs

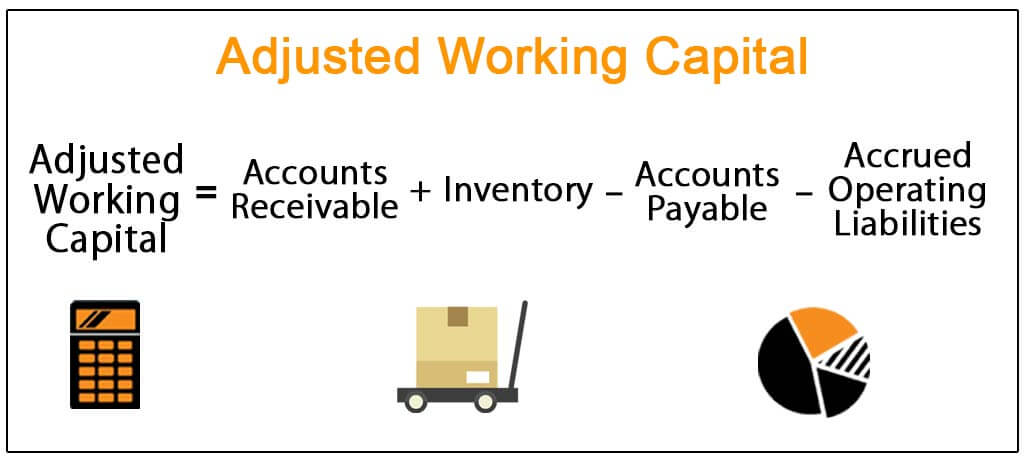

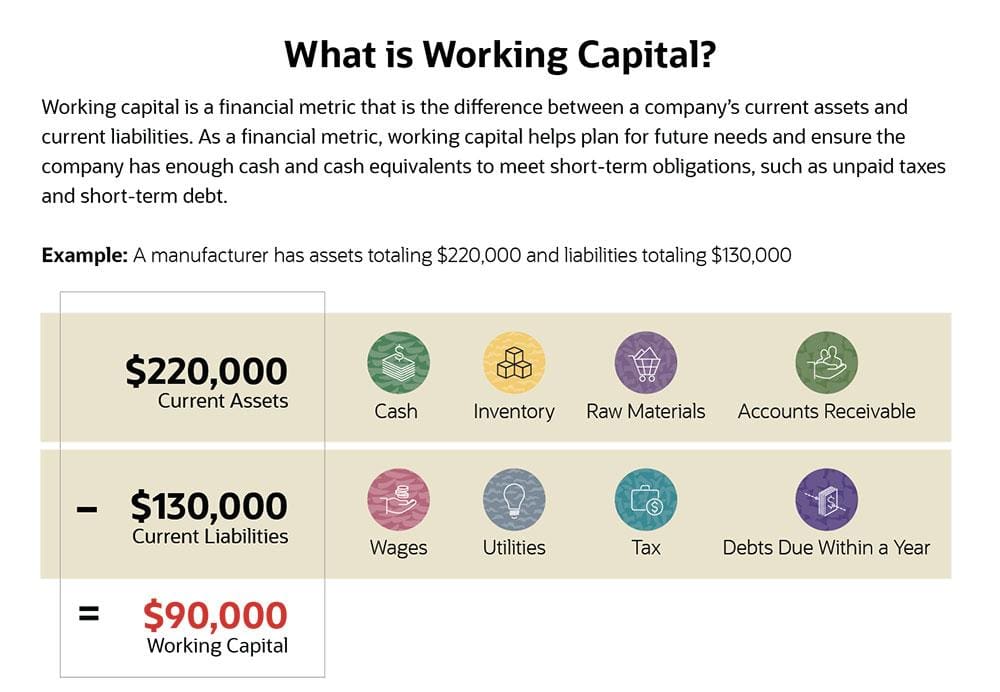

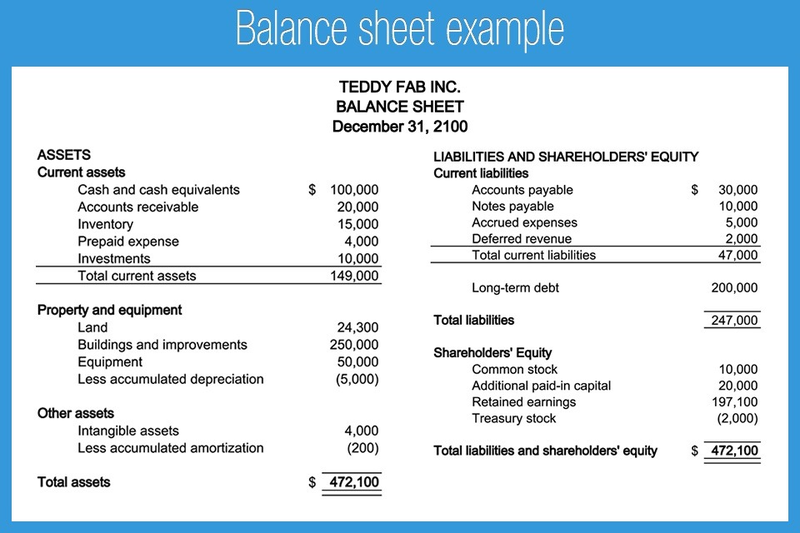

Working capital adjustments are required when a going concern business is acquired by way of a share purchase This is the case for two main reasons (i), because working capital changes every day as revenues are generated and supplier and payroll payments are made, and (ii), because working capital is easily manipulated in a material way (for example, the seller could withdrawFormula The working capital ratio is calculated by dividing current assets by current liabilities Both of these current accounts are stated separately from their respective longterm accounts on the balance sheet This presentation gives investors and creditors more information to analyze about the company Current assets and liabilities are Formula Net Working Capital = Current Assets (less cash) – Current Liabilities (less debt) or, NWC = Accounts Receivable Inventory – Accounts Payable The first formula above is the broadest (as it includes all accounts), the second formula is more narrow, and the last formula is the most narrow (as it only includes three accounts)

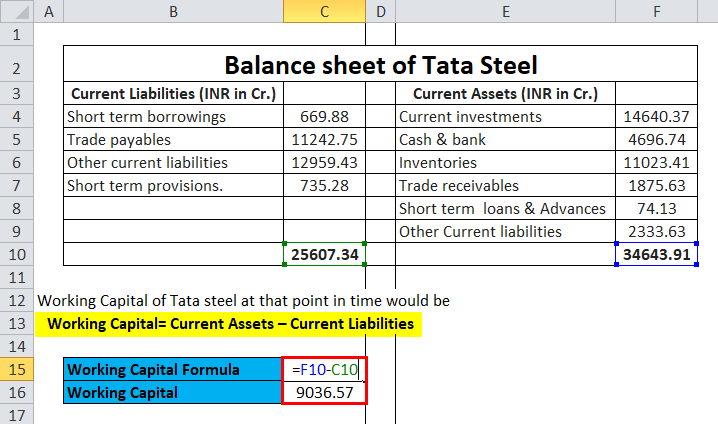

Net Working Capital Formula = Current Assets – Current Liabilities = (Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors) – (Creditors ShortTerm Loans) = $135,000 – $55,000 = $80,000 So, the Net Working Capital of Jack and Co is $80,000Working capital (also known as net working capital) is defined as current assets minus current liabilities Therefore, a company with $1,000 of current assets and $90,000 of current liabilities will have $30,000 of working capital A company with $100,000 of current assets and $100,000 of current liabilities has no working capital Although an optimal level of working capital may exist it may not be achievable due to factors beyond management's control, such as an unreliable supply chain influencing inventory levels However businesses must at least avoid the extremes Overtrading – insufficient working capital to support the level of business activities

Working Capital Turnover Ratio Meaning Formula Calculation

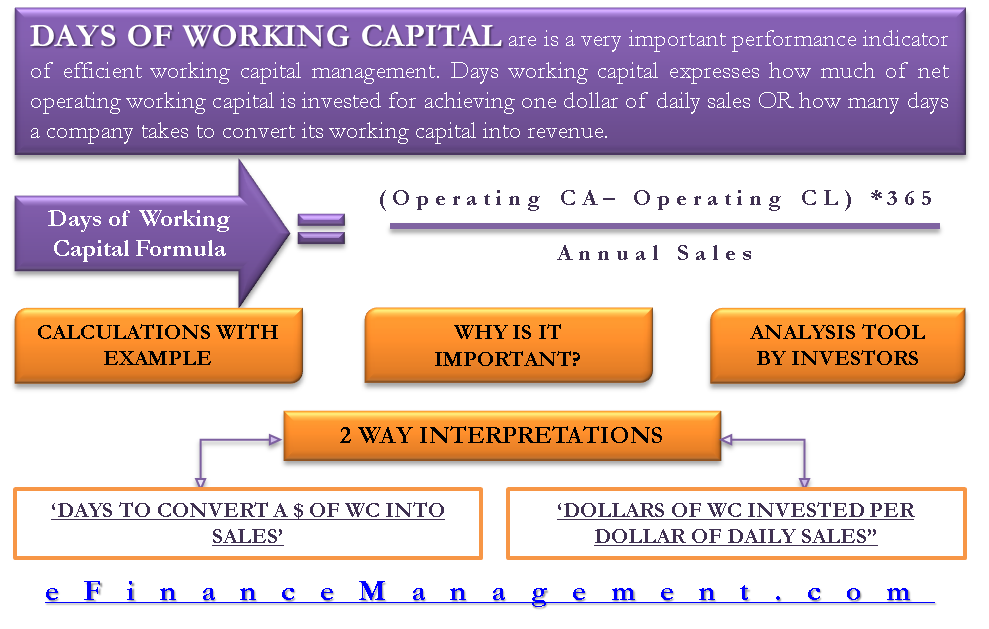

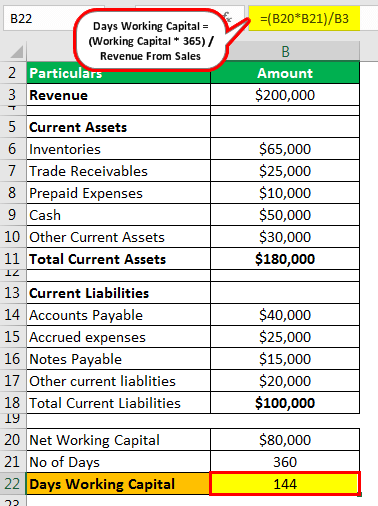

Days Working Capital Formula Calculate Example Investor S Analysis

Sales to working capital ratio is a liquidity and activity ratio that shows the amount of sales revenue generated by investing one dollar of working capital Assets, also called working capital, represent items closely tied to sales, and each item will directly affect the resultsThat is, the ability to meet obligations when due At a high level, the calculation of working capital is as follows Current assets Current liabilities = Working capital Negotiating working capital is one of the most contentious issues in closing a deal That's because determining the amount of sufficient working capital needed to fund ongoing business is a complicated exercise Robert B Moore, Partner, McGladrey LLP, has expertly summarized the issues is his white paper, "Negotiating Working Capital Targets and Definitions"

The Ins And Outs Of Business Working Capital Calculation Examples

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Definition

Normalized Working Capital definition Normalized Working Capital means the negative amount equal to () €3,238,850 ( minus three million, two hundred and thirty eight thousand, eight hundred and fifty euros ) Normalized Working Capital means, with respect to any Person as of any date, the average level of netWorking capital formula and definition A key part of financial modeling involves forecasting the balance sheet Working capital refers to a specific subset of balance sheet items The definition of working capital (shown below) is simple Working capital = Current assets – current liabilities Working capital is calculated by subtracting current liabilities from current assetsIt is used in several ratios to estimate the overall liquidity of a business;

Working Capital Management Businance

Net Working Capital Formulas Examples And How To Improve It

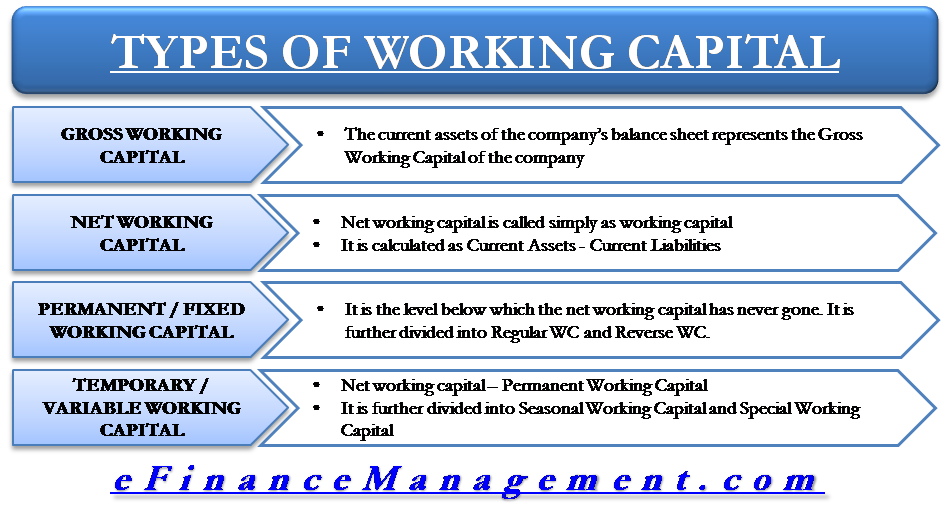

Currents assets minus current liabilitieADVERTISEMENTS The following points highlight the top approaches of working capital management strategies They are 1 Conservative Approach 2 Aggressive Approach 3 Matching Approach 4 Zero Working Capital Approach 5 Working Capital Policies 1 Conservative Approach A conservative strategy suggests not to take any risk in working capital management Excess working capital carries the 'carrying cost' or 'interest cost' on the capital lying unutilized Shortage of working capital carries 'shortage cost' which include disturbance in production plan, loss in revenue etc Finding the optimum level of working capital is the main goal or winning situation for any business manager

Working Capital Examples Top 4 Examples With Analysis

Days Working Capital Definition Formula How To Calculate

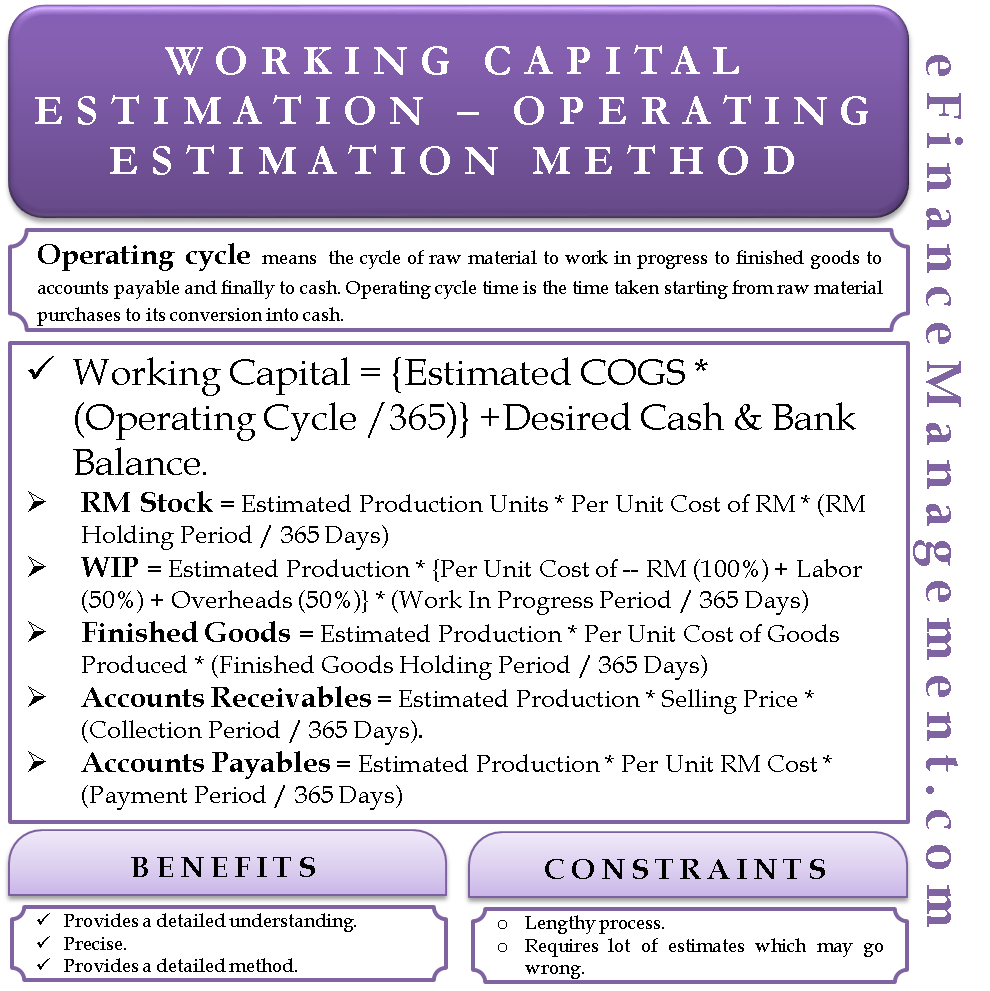

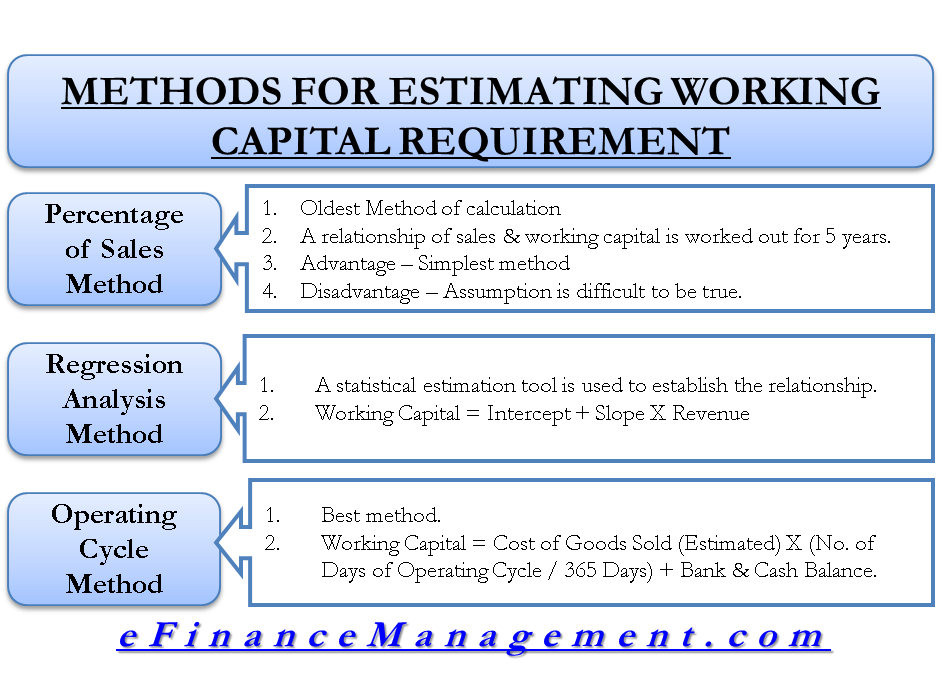

What is working capital?ADVERTISEMENTS The following points highlight the top three methods of working capital estimation The methods are 1 Percentage of Sales Method 2 Regression Analysis Method 3 Operating Cycle Method 1 Percentage of Sales Method It is a traditional and simple method of determining the level of working capital and its components In this method, working"Working capital" is the money you need to support shortterm operations It is this focus on the short term that distinguishes working capital from longerterm investments in fixed assets or R&D Working capital is the difference between current assets and current liabilities "Current" again refers to the fact that these items fluctuate in the short term,

Working Capital Formula How To Calculate Working Capital With Example Youtube

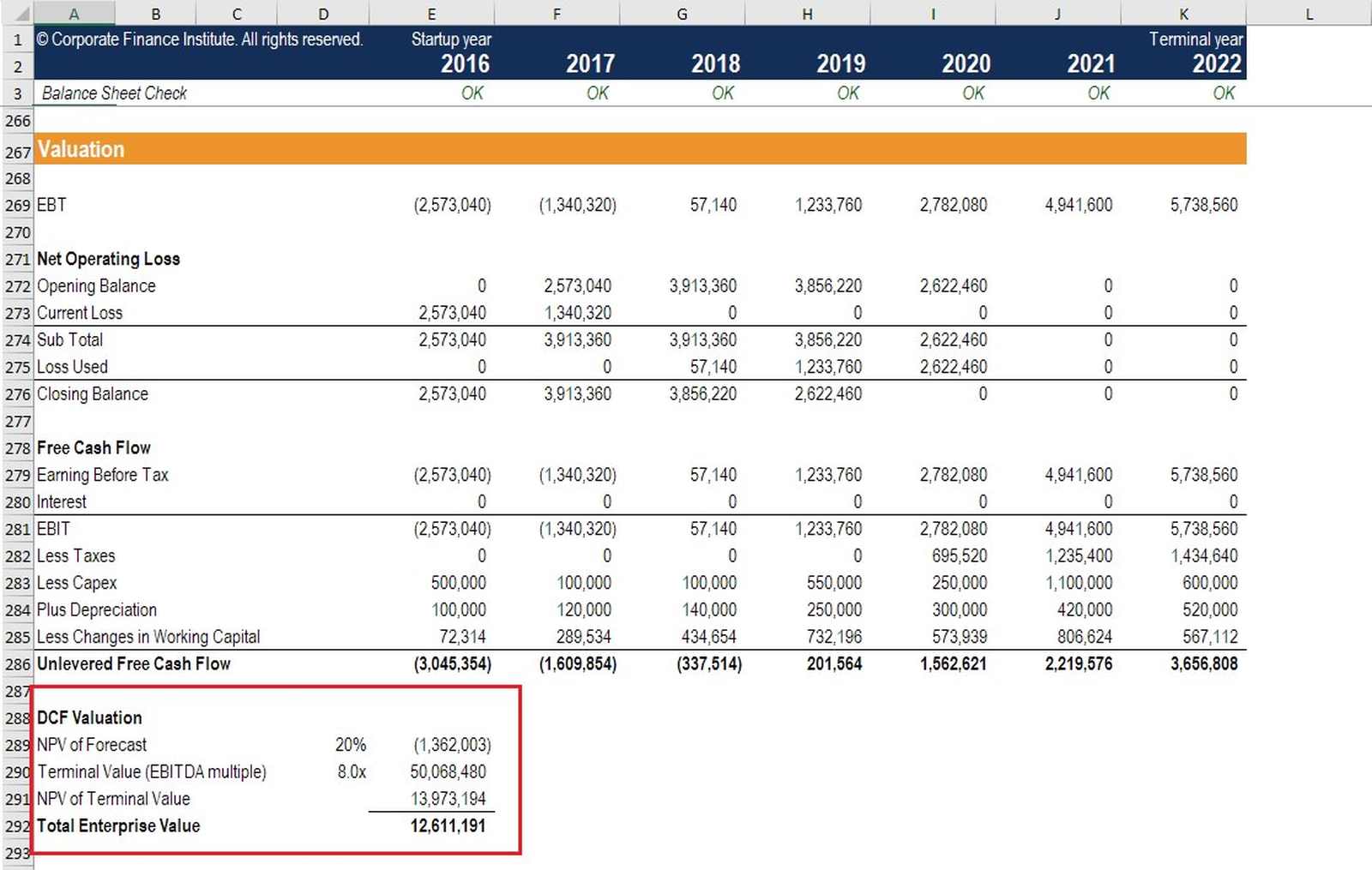

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Net working capital is also known simply as "working capital" NWC is a way of measuring a company's shortterm financial health In other words, a company's ability to meet shortterm financial obligations Its ability to keep running and growing business operations You take all your total current assets You subtract your currentThere are several working capital investment policies a firm may adopt after taking into account the variability of its cash inflows and outflows and the level of risk 1 Hedging Policy One of the policies by which a firm finances its working capital needs is the hedging policy, also known as matching policyNet working capital formula Current assets – Current liabilities = Net working capital For these calculations, consider only shortterm assets such as the cash in your business account and the accounts receivable — the money your customers owe you — and the inventory you expect to convert to cash within 12 months

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Financial Edge

Working Capital Needs Calculator Your working capital is used to pay shortterm obligations such as your accounts payable and buying inventory If your working capital dips too low, you risk running out of cash Even very profitable businesses can run into trouble if they lose the ability to meet their shortterm obligationsA workingcapital hurdle is a predetermined workingcapital amount that is assumed in the purchase price For example, a deal might include a purchase price of $55m based on the seller's delivery of $8m of working capital at closing The workingcapital hurdle could also be set as a range ($75m to $85m, for example) Working capital = current assets less current liabilities Working capital provides a strong indication of a business' ability to pay is debts Every business needs to be able to maintain daytoday cash flow It needs enough to pay staff wages when they fall due, and to pay suppliers when invoice payment terms are reached

1

How To Calculate Working Capital With Calculator Wikihow

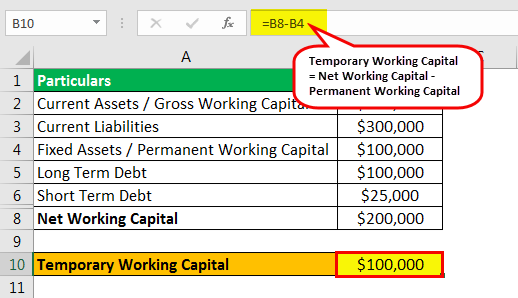

Permanent working capital is the minimum investment required in working capital irrespective of any fluctuation in business activity Also known as fixed working capital, it is that level of net working capital below which it has never gone on any day in the financial year Net working capital (NWC) means current assets less current liabilities The level of working capital affects the degree of risk and profitability both Hence the level of working capital should be so fixed that, on the one hand, its financial soundness is maintained and on the other hand, its profitability is optimized At this point it is necessary to be clear about the meaning of solvency or insolvency of the firmNet working capital in M&A deals In a transaction, the concept of working capital is a bit different While still calculated as current assets minus current liabilities, all cash or debt balances are excluded (as well as any cashlike or debtlike items)Furthermore, working capital is broken down in trade working capital and other working capital

Working Capital Formula Calculator Excel Template

Days Working Capital Definition Formula How To Calculate

Working capital, like cash flow, is something that is constantly changing Due of this, to calculate your business's current amount of working capital, you'll need to review your balance sheetIn this blog post, we'll explain how to correctly do this so that you can take charge of your business financesNet working capital – this is what people generally mean when they talk about working capital;Working Capital Requirement is the amount of money needed to finance the gap between disbursements (payments to suppliers) and receipts (payments from customers) Almost every company must incur expenses before obtaining the fruits of his labor (the payment of customer invoices) The nature of these costs depends on the activity

Change In Working Capital Video Tutorial W Excel Download

How To Calculate Working Capital The Working Capital Formula

Understanding Working Capital Targets in M&A Transactions We have found that net working capital ("NWC") targets are one of the most commonly misunderstood components of M&A deals While sometimes confusing, we believe sellers need to understand the logic behind NWC targets, as it can often become one of the more heavily negotiated itemsWorking Capital Ratios (liquidity) • The "liquidity position" of a business refers to its ability to pay its debts – ie does it have enough cash to pay the bills? The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales Working capital is current assets minus current liabilities A high turnover ratio indicates that management is being extremely efficient in using a firm's shortterm assets and liabilities to support sales

Working Capital Formula How To Calculate Working Capital

Working Capital Financial Edge

Now, lets us apply the formula to determine the working capital of Max Electronics Working Capital = Current Asset Current Liabilities 72,26,215 – = 35,25,869 The working capital of Max Electronics is 35,25,869 Types of working capital management ratios Working capital is a measure of both a company's efficiency and its shortterm financial health Working capital is calculated as Working capital is a reflection of current shortterm financial health It indicates whether a business has enough shortterm assets to cover daytoday operations and shortterm debt But, while similar, WC and cash flow aren't the same Both are critical measurements of financial health Working capital is a snapshot of a present situation

How To Calculate Working Capital With Calculator Wikihow

Net Working Capital Guide Examples And Impact On Cash Flow

The working capital formula tells us the shortterm liquid assets available after shortterm liabilities have been paid off It is a measure of a company's shortterm liquidity and is important for performing financial analysis, financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a company's financial performance• The balance sheet of a business provides a "snapshot" of the working capital position at a particular point in time Working capital is the amount of money a company has left over after subtracting current liabilities from current assets Working capital tells you if a company can pay it's shortterm debts and have money left over for operations and growth Working capital should be used in conjunction with other financial analysis formulas, not by itself

Working Capital Example Formula Wall Street Prep

Assessment And Computation Of Working Capital Requirement

Working Capital Definition Formula Examples With Calculations

How To Calculate Working Capital The Working Capital Formula

3

Types Of Working Capital Gross Net Temporary Permanent Efm

17 Level I Cfa Corporate Finance Working Capital Summary Youtube

Working Capital Example Formula Wall Street Prep

How To Calculate Working Capital Requirement Plan Projections

What Is Working Capital Definition Formula Examples

Days Working Capital Definition Formula How To Calculate

Management Financing Of Working Capital Koray Erdoan Fin

Working Capital Management Acca Global

Changes In Net Working Capital Step By Step Calculation

Working Capital Management Businance

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

Working Capital Definition Elements Formula Calculation Example Cycle

Change In Net Working Capital Formula Calculator Excel Template

How To Calculate Working Capital Requirement Plan Projections

How To Calculate Working Capital With Calculator Wikihow

Net Working Capital Formula Example Calculation Ratio

Working Capital Cycle Understanding The Working Capital Cycle

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

Working Capital Example Formula Wall Street Prep

:max_bytes(150000):strip_icc()/workingcapital-7044a3fc24ff4cb48cddab89700ee12d.jpg)

What Is Working Capital

Net Working Capital Formulas Examples And How To Improve It

Working Capital Formula Calculator Excel Template

Adjusted Working Capital Definition Formula Example

Importance Of Working Capital Top 11 Importance Of Working Capital

Working Capital What It Is And How To Calculate It Efficy

Change In Net Working Capital Formula Calculator Excel Template

What Is The Working Capital Formula Revenued

Operating Working Capital Owc Financial Edge

What Is Working Capital How To Calculate And Why It S Important Netsuite

Working Capital The Definition Formula

Working Capital Example Formula Wall Street Prep

Working Capital Cycle Understanding The Working Capital Cycle

Net Working Capital Guide Examples And Impact On Cash Flow

Working Capital What It Is And How To Calculate It Efficy

1

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

1

Working Capital Cycle

Working Capital Estimation Of A Firm 4 Methods Financial Management

A Small Business Guide To Calculating Net Working Capital The Blueprint

Net Working Capital Formula Calculator Excel Template

Working Capital Example Meaning Investinganswers

What Is Working Capital Definition Formula Examples

Working Capital Estimation Operating Cycle Method

Working Capital Management Acca Global

Methods For Estimating Working Capital Requirement

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Net Working Capital Guide Examples And Impact On Cash Flow

What Is Working Capital Here S Everything You Need To Know Freshbooks Blog

Net Working Capital Formula What It Is How To Calculate It And Examples Planergy Software

How To Calculate Working Capital With Calculator Wikihow

Cfa Level I Working Capital Management Part I Youtube

How To Calculate Working Capital With Calculator Wikihow

Working Capital Management Businance

Working Capital Formulas And Why You Should Know Them Fundbox

Working Capital Meaning Ratio Example Formula Cycle

Working Capital Management Acca Global

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Formula Youtube

Days Working Capital Definition Formula How To Calculate

What Is Net Working Capital How To Calculator Nwc Formula

Working Capital Example Formula Wall Street Prep

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Ratio Formula Examples Calculation Youtube

Working Capital Net Current Assets Tutor2u

How To Calculate Working Capital With Calculator Wikihow

Change In Net Working Capital Formula Calculator Excel Template

What Is Working Capital Definition Formula Examples

Working Capital Management Module 1 Introduction Working Capital Or Short Term Finance Refers To Current Assets And Current Liabilities There Are Two Ppt Download

Change In Working Capital Video Tutorial W Excel Download

Working Capital In Valuation

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Definition

Days Working Capital Definition Formula How To Calculate

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Working Capital What Is It And Why It S Important